Effective Insurance Programs — Start With a Plan

Not surprisingly, perhaps 95 percent of the consumers I meet with to review their insurance programs focus their discussions exclusively on the insurance policies they own. Ours is a product-focused culture, and our buying decisions are often guided by products that receive 5-star reviews, Consumers Digest Best Buy recommendations, and Editors Top Picks selections uncovered from an internet search. While product reviews can be valuable, the behavioral psychology that influences modern advertising has robbed us of the ability to ask ourselves more important questions, questions like, “Why am I buying this product?”

Why buy an insurance policy for your home or your car? When I ask prospective clients these questions, I often receive an expression suggesting puzzlement, annoyance, or both. To ease those emotions, I ask if the real reason is to replace owned property if it is damaged or destroyed. “Of course!” is the most common answer. Since the real reason to buy insurance is to replace what we own in the event of an unforeseen loss, why is it that so many otherwise savvy consumers instead purse the “Save Money Now” call to action that is so prominent in most insurance advertising campaigns? Capitalizing on our focus on product over process, insurance providers and their advertisers have essentially made saving money on your insurance coverage their product. They are not alone.

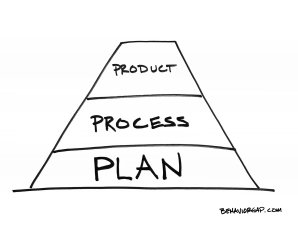

Carl Richards, contributor at The New York Times Bucks Blog and the author of The Behavior Gap, reminds us that in the financial services industry, consumer focus on product is exploited by those who are paid to sell product. Richards is well known for using simple illustrations that lend clarity to issues that many journalists do not understand. While the lesson of the illustration above is aimed at investors, it is just as relevant to consumers seeking the right way to protect their homes, cars, and other tangible and financial assets from unforeseen loss. Richards explains: “Most of us are trained to think ‘What’ first, because it’s what you hear about all day long. It’s the message you read in financial publications and see on CNBC. But ‘What’ questions should come after we think about ‘Why’ and ‘How.’ Starting with ‘Why’ means achieving clarity about your personal financial goals and creating a plan.”

Thank you, Carl Richards, for reminding us that before we focus on the “What” product solutions, we first need to start by asking ourselves the larger “Why” questions. I am happy to be a resource to financially successful individuals and families eager to examine and address the important questions that often expose their assets to uncovered losses.

Tim O’Brien

SVP, Property & Casualty

Assurex Global

Leave a Reply

Want to join the discussion?Feel free to contribute!