Employee Benefits Market Check Survey: HSA Contribution and Administration Perspectives

Twenty years after health savings accounts (HSAs) became effective, employers continue to offer them as an option with great frequency (see our October 2023 Market Check Survey for more information). Further, many are also providing an employer contribution to the account. There are several strategies a company can take when deciding how and when to fund an HSA.

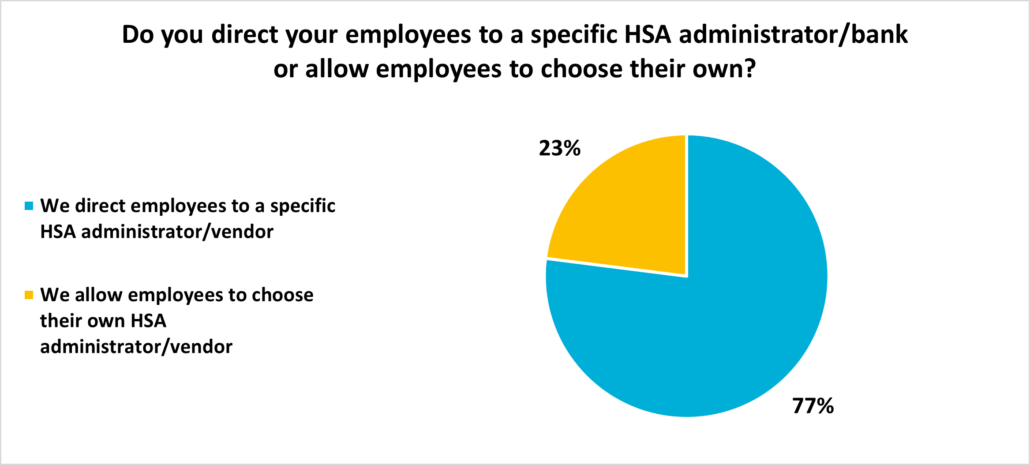

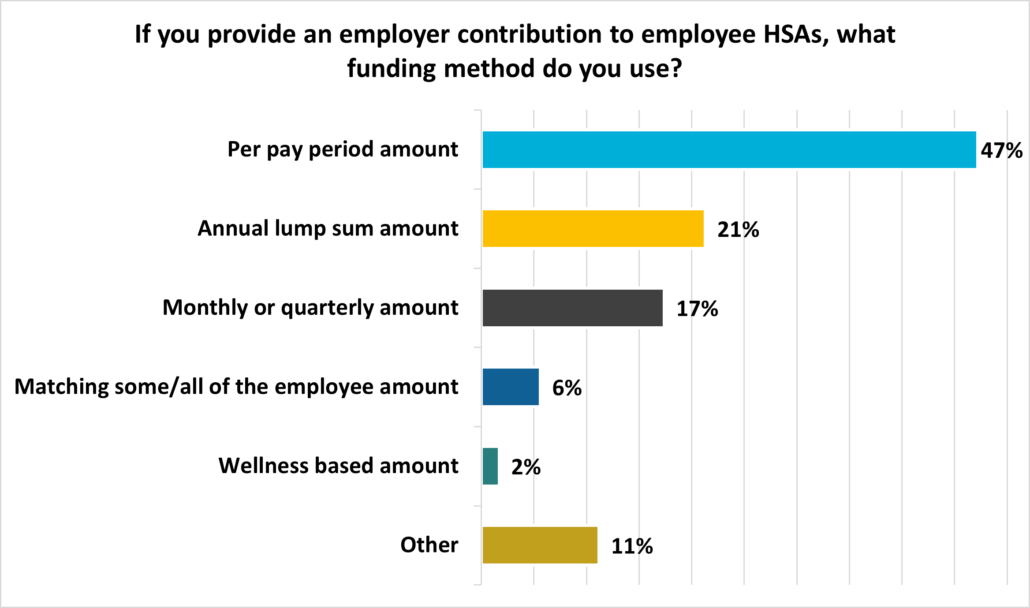

We conducted two polls on June 20. The results are in the chart(s) that follow.

*Results based on 183 employer respondents.

Respondents were allowed to select multiple answers to the second question.

Key Findings

The way employers fund and administer their HSA will significantly impact employee usage and satisfaction with the offering. With most employers offering an HSA option and well over half making an employee contribution, many things must be considered to ensure employees’ needs are met and ease the employer’s administrative and financial burden.

Most employers provide their employees with an HSA account administrator or vendor, likely to lessen the confusion around HSAs and ensure ease of enrollment and contribution deposits.

Many employers fund their employees’ HSA accounts on a per-pay period basis, which offers several advantages, such as consistent cash flow for employees and ease of budgeting for employers. Each funding scenario presents unique pros and cons, and employers should continue to evaluate their HSA strategy to confirm it fits within their broader financial wellness philosophy.

Should you have any questions regarding any of this information or want to discuss HSAs or industry-specific data, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!