Employee Benefits Market Check Survey: Long-Term Care Coverage

Long-term care insurance (LTC) is designed to help those people who receive custodial care in a facility or their home and require assistance with certain activities of daily living (bathing, dressing, etc.). LTC insurance has been around for a long time, but the products in the market have changed significantly over the past 20 years. The need for LTC coverage has always been prominent, but legislative activity at the state level has brought the topic back to the spotlight.

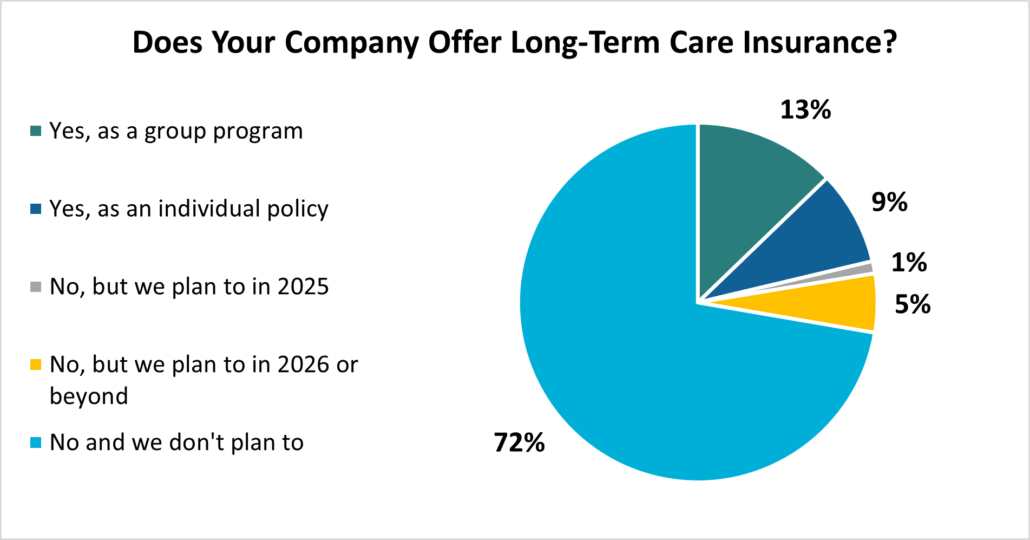

On October 17, we conducted a survey to better understand how employers approach LTC within their employee benefit packages. The results are in the charts below.

*Results based on 188 employer respondents.

Type of LTC Policy Offered

44% provide LTC on a voluntary basis (100% employee paid).

38% provide employer paid coverage.

13% provide an employer paid rider to the Group Life policy.

5% provide a voluntary rider to the Group Life policy.

Primary Reasons for Offering/Not Offering LTC Insurance

For Those That Offer LTC

54% As a complement to our voluntary benefit portfolio

17% It is a core component to our broader financial wellness strategy

17% To provide employees access to meaningful and affordable with GI and group pricing

12% To address employee needs and request for LTC planning

For Those That Do Not Offer LTC

32% Lack of employee interest/demand

25% Cost to the company

23% Availability of other benefits deemed more important

20% Not aware of LTC options

Key Findings

Most employers do not offer long-term care insurance as part of their benefits package. While some provide access to voluntary or employer-paid options, comprehensive coverage remains uncommon. As the need for long-term care continues to grow with an aging workforce, offering this benefit could set employers apart and help support employees’ future well-being and retirement goals.

The odds that individuals will need long term care at some point are quite high. Unfortunately, many still believe that long term care services will be covered by some form of Medicare/Medicaid, long-term disability or health insurance. Since these products provide minimal to no protection for long-term care, many will turn to retirement savings to help cover the costs or go into debt. LTC insurance can not only help cover some of the expenses, it can also help in alleviating financial and mental stress.

LTC insurance offers significant benefits by providing financial protection and peace of mind to employees and their families. As more states look to enact some type of public LTC plan, the conversations regarding long-term care will only increase. Public plans may not provide substantial coverage and may add additional taxes to workers and/or businesses. While this isn’t the only reason to consider offering LTC insurance, employers should be prepared for a possible increase in demand from its workforce.

Should you have any questions regarding any of this information or want to discuss your LTC offerings, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!