Assurex Global Market Check Survey: 2020 Employer ACA Reporting

The Affordable Care Act (ACA) requires that applicable large employers and all size employers that offer self-insured group health plans provide the Internal Revenue Service (IRS) with information as it relates to offers of coverage and enrollment. This requirement helps satisfy the employer mandate and has been in place since 2015. Despite being in effect for a few years, many employers remain challenged in getting the information submitted in a timely and accurate fashion. Reporting for this year may be even more difficult for employers that experienced record numbers of leaves of absence, furloughs or terminations.

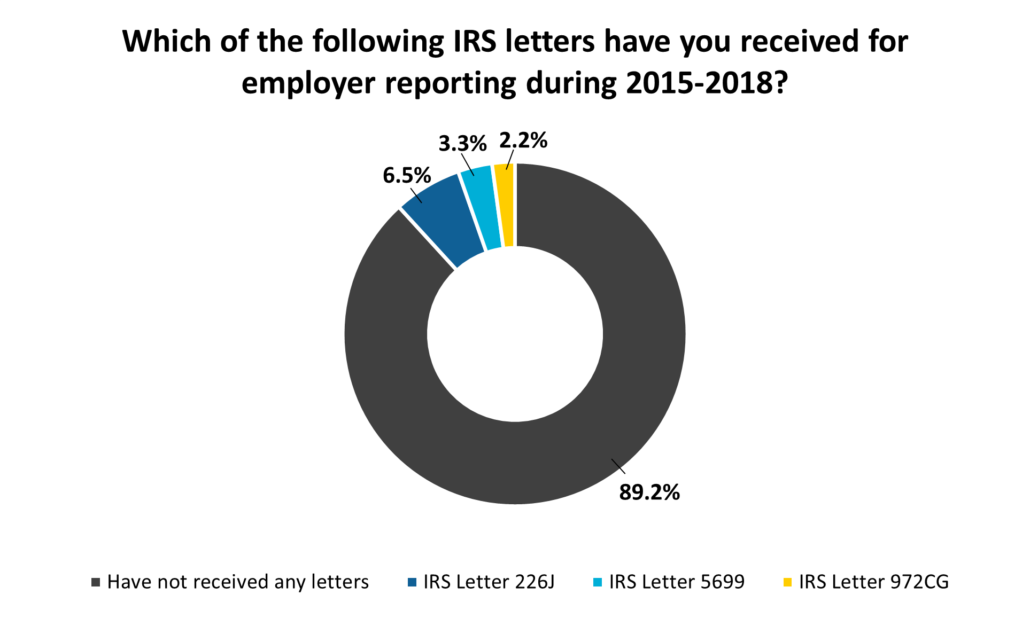

We conducted a poll during a webcast covering this topic on November 19 and the results are in the charts below.

As the IRS continues to increase its oversight into group health plans, it is suspected that more employers may receive letters in the coming year. Should you need assistance with reporting, or if you receive a letter, please contact your local Assurex Global adviser.

Letter 226J – IRS sends this initial letter to Applicable Large Employers (ALE) that may not have offered minimum essential coverage

or offered coverage that was of minimum value and affordable

Letter 5699 – IRS sends this when they believe employer is an ALE and did not report

Letter 972CG – IRS sends this letter to inform employer that they are assessing a filing penalty

Leave a Reply

Want to join the discussion?Feel free to contribute!