Employee Benefits Market Check Survey: Annual Enrollment Practices

Annual benefits enrollment is a crucial period for both employers and employees. It sets the stage for the coming year’s benefits plans and significantly influences employees’ overall perceptions of their benefits packages specifically and their employer holistically. During this time, employees can review and make informed decisions about their options and costs, ensuring they have the coverage and support they need for the upcoming year.

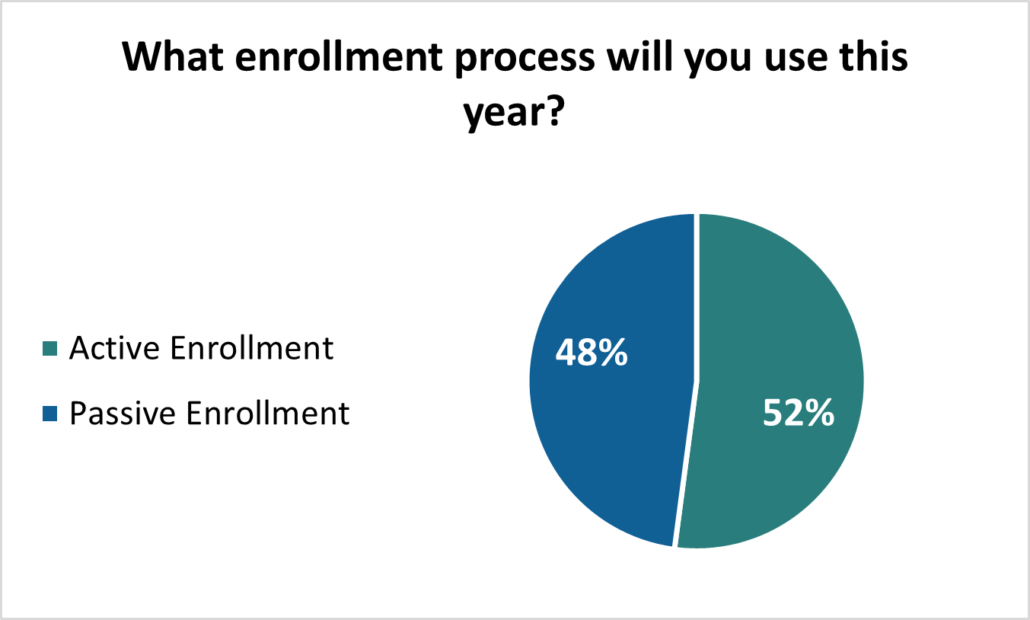

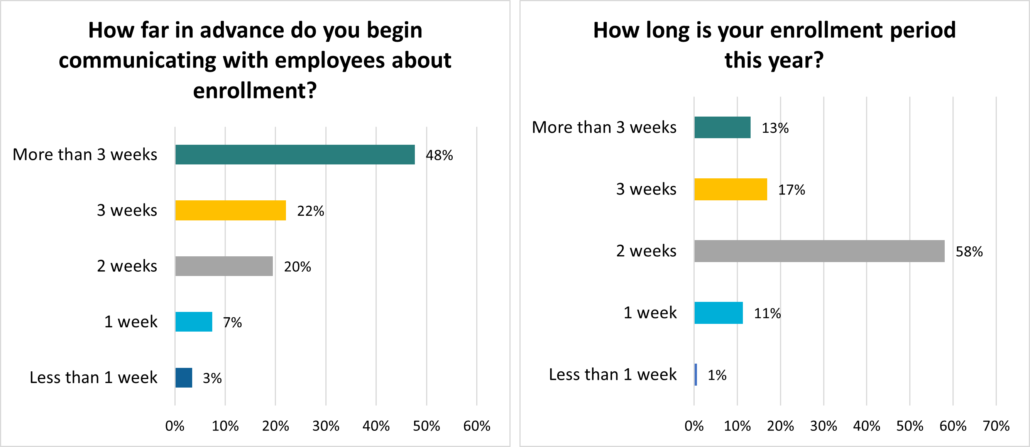

Employers take various approaches to annual enrollment. In August 2024, we conducted a survey to better understand current practices. The results are in the charts below.

*Results based on 163 employer respondents.

Active Enrollment requires employees to actively review and select their benefits options each year, even if they wish to keep the same plans.

Passive Enrollment automatically renews employees’ existing benefits selections, unless they choose to make a change.

Key Findings

The methods and strategies employers adopt for annual enrollment play a critical role in shaping the employee experience and ensuring that workers are well-informed and adequately covered. We found that an active enrollment process was slightly more common than a passive process. Both have pros and cons, and each employer’s strategies will vary based on their demographics, benefits goals, capacity of the HR team, and more. Active enrollment ensures employees are aware of changes or new offerings and make conscious choices about their coverage each year. Passive enrollment is more convenient for employees but can lead to complacency and less awareness of benefit options.

Earlier this year, we asked employers about their opportunities to improve their annual enrollment. The number one response was “increase education of the benefit program” followed by “change how we communicate the program.” Employers know that annual enrollment is a critical time to educate employees about the benefits programs, and they must be very strategic to maximize this opportunity.

Most employers prefer communicating changes more than three weeks before annual enrollment. Communicating changes to the benefits program well before annual enrollment allows employees more time to understand and evaluate their options. Still, it can also lead to information overload and a longer period of uncertainty, while waiting until enrollment opens ensures information is fresh but may rush employees into making decisions without ample consideration. Regardless of your active/passive stance, clear communication of the benefit offerings is critical and must occur across multiple channels.

Two weeks was the most common annual enrollment window among respondents. A shorter window can streamline the process and reduce administrative burden, but it may limit employees’ time to thoroughly review and choose their benefits. A longer window allows for more informed decision-making but can prolong the administrative efforts and potentially delay finalizing enrollments.

Should you have any questions regarding any of this information or want to discuss your enrollment practices or industry-level data, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!