Employee Benefits Market Check Survey: Benefit Priorities & Strategies in 2025

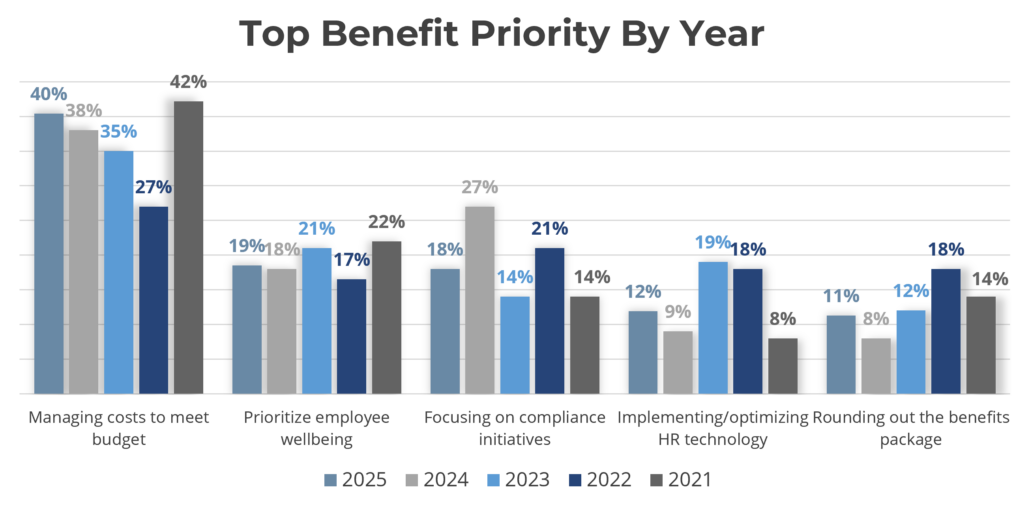

As another year has kicked off, employers have many areas of focus regarding their benefit programs. It can also be challenging to achieve all goals in a single year, so decision-makers must prioritize their efforts based on their unique circumstances.

On February 20, we conducted a survey to gain insight into employers’ top priorities for 2025 and how they compare to prior years. We also sought to understand the strategy(ies) employers are deploying to manage their benefits costs. The results are detailed below.

*2025 results based on 344 employer respondents.

Benefit managers always have an eye on the program’s finances, and with inflation, rising pharmacy spending, and continued chronic conditions, this year will be a challenging one in the cost area. As such, it is no surprise that four in ten employers say managing costs to meet their expected budget is the #1 priority this year (the highest rate since 2021).

Strategies to Manage Benefit Costs to Meet Budget

29% Add a wellness program

Compared to 14% in 2024

14% Offer direct primary care/concierge services

Compared to 2% in 2024

11% Implement disease/care management program

Compared to 6% in 2024

7% Exclude coverage for certain drugs

Compared to 6% in 2024

6% Transfer stop-loss coverage to group captive

Compared to 3% in 2024

3% Add Center of Excellence (COE)

Compared to 0% in 2024

3% Provide second opinion program

Compared to 0% in 2024

41% Are taking no specific action

Compared to 60% in 2024

Key Findings

The January 2025 renewal cycle was difficult, with 39% of employers seeing their medical costs increase by 7% or more after all changes were implemented. After absorbing significant premium increases, ensuring that costs do not exceed budget is even more critical. Plan sponsors cannot afford to sit idle. Almost 60% of employers are deploying strategies this year to help manage their costs – a 20% increase from last year. This effort is led by expanding opportunities for employees to improve their health, with twice as many employers investing in wellness programs as last year.

With a proactive approach, employers can work to impact their benefits spend. While nearly 40% have yet to implement specific strategies, those who do have the opportunity to improve financial stability, enhance employee well-being, and better navigate future renewal cycles. By making thoughtful adjustments, employers can balance affordability with the need to offer competitive benefits.

Should you have any questions regarding any of this information or want to review your priorities or industry-level data, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!