Employee Benefits Market Check Survey: Domestic Partner Coverage

Although not required by federal law, many employers offer coverage to domestic partners to attract and retain top talent and avoid discrimination issues. Employers who aim to promote an image of workplace equality may find that offering domestic partner coverage helps them do so, as domestic partner coverage helps accommodate the needs of modern and nontraditional relationships. While this may be attractive to employees, it is not without additional complexity and cost for the company. We conducted a poll during a webcast on February 23 to gain insight into how employers address domestic partners today and their plans for the future. The results are in the charts below.

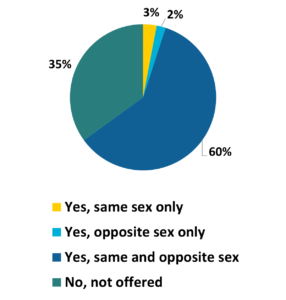

Does your company currently offer

domestic partner coverage?

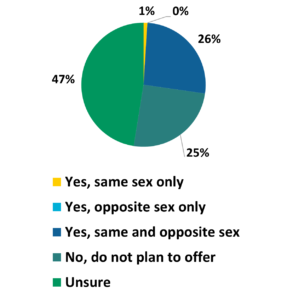

If your company does not offer

currently, are there plans to do so in

the future?

Key Findings

Access to quality healthcare coverage is critical for every person’s well-being, and offering domestic partner coverage increases coverage availability to people who may not otherwise have it. With most respondents providing coverage to domestic partners now and another 27% planning to add it, employers who do not offer domestic partner coverage may be at a competitive disadvantage to their peers, especially in certain industries. Expanding access to the company plan could cost the company more money. As state and local governments become more involved in healthcare, employers must monitor legislative developments to ensure compliance. Further, employers must also stay vigilant regarding payroll, COBRA continuation, account-based plans, and more.

Should you have any questions or are interested in any industry-specific data, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!