Employee Benefits Market Check Survey: Employer Reporting Methods

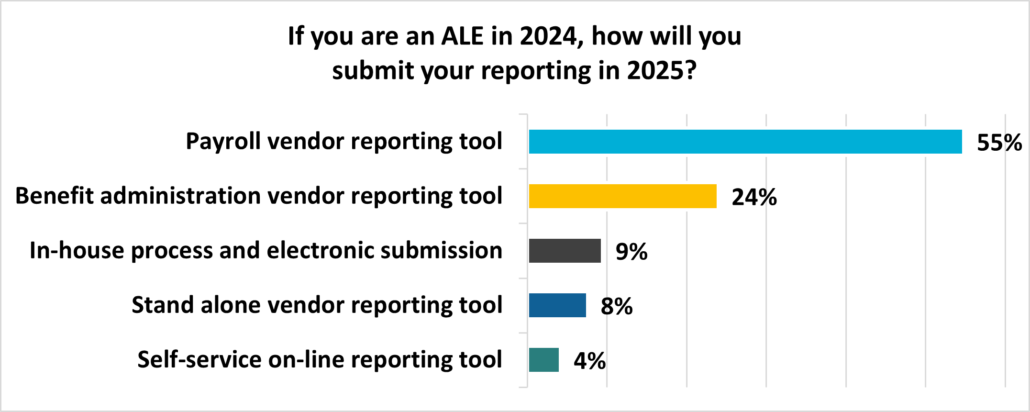

One of the provisions of the Affordable Care Act requires applicable large employers (those with an average of 50 full-time employees over the previous calendar year) to report health plan information and participant coverage data to the IRS via Forms 1094 and 1095. The reporting is done annually and needs to be done early in the year. There is no requirement on how the data is submitted, so various options are available. We conducted a poll on July 25. The results are in the chart below.

*Results based on 212 employer respondents. ALE = Applicable Large Employer

Key Findings

The data shows that most employers submit their data to the IRS using a reporting tool. Most employers find success utilizing their existing payroll or benefit administration providers’ solutions. Payroll vendors are familiar with filing tax forms, while benefit administration vendors already maintain the necessary information. Those with particularly complex needs may look to a standalone vendor specializing in ACA reporting, but they should note that these solutions may require more intervention from the employer.

While there is no correct method to use when submitting reports to the IRS, employers must ensure their reporting is accurate, and it is important to understand that most reporting tool vendors take on little to no liability for the accuracy of the reports. The IRS has increased its enforcement of the reporting requirements, so employers should partner with a trusted vendor and thoroughly review and approve any submission to the IRS.

Should you have any questions regarding any of this information or want to discuss your reporting needs or industry-specific data, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!