Employee Benefits Market Check Survey: Health Savings Accounts Contributions

Health Savings Accounts (HSAs) are a tax-advantaged and flexible savings option employers can offer their employees as part of their benefits package. HSAs are celebrating their 20th year in the market and are common in many employee benefit offerings. As out-of-pocket costs have risen, they have helped make health care more affordable to consumers and employers. While HSAs can play an important role in a company’s employee benefits package and its broader financial wellness strategy, they continue to be misunderstood by consumers and employers alike. Thus, opportunities remain to make HSAs even more valuable.

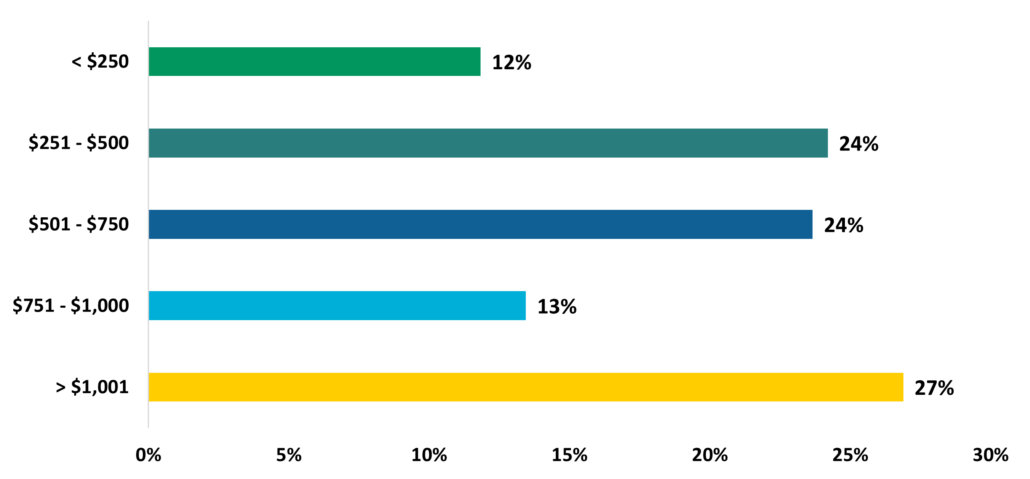

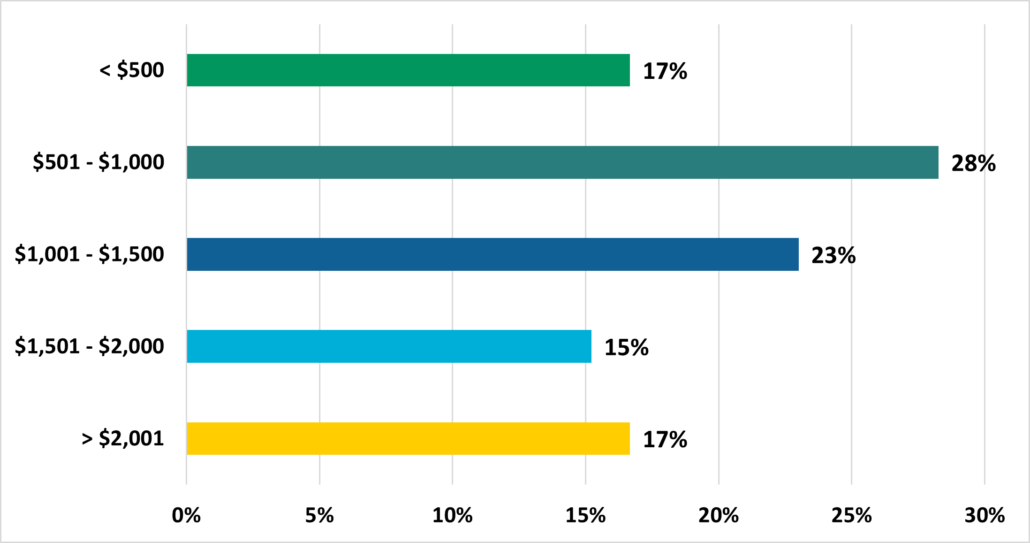

We conducted a poll during a webcast on October 19 to gain insight into how much employers contribute to their employees’ HSA. The results are in the charts and images below.

Based on 350 employer responses

How much do you contribute to an employee’s HSA for single coverage?

How much do you contribute to an employee’s HSA for family coverage?

Key Findings

HSAs can be a great tool for employees for numerous reasons. However, many account owners struggle to contribute to their accounts and maintain a worthwhile balance. An employer’s contribution to the HSA can motivate employees to participate in and contribute to the HSA. However, we found one-third of employers offering an HSA do not provide company contributions to the account. A company contribution provides a great opportunity to enhance the overall rewards package provided to the workforce, and there are several flexible contribution funding strategies to consider.

For employers that are contributing to the account, now is an opportune time to review the current funding design to see if it still meets the needs of the employees as well as the goals of the business.

Providing robust and ongoing education about HSAs is key to employee adoption and understanding. As employers prepare for enrollment season, those that offer an HSA should provide targeted education to employees based on their current behaviors to ensure they are comfortable with all the positive features an HSA can provide.

Then, schedule multiple touch points throughout the year across various channels and include planning tools to aid in modeling contribution, investment, and withdrawal scenarios.

Should you have any questions regarding any of this information or want to discuss industry-specific data, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!