Employee Benefits Market Check Survey: Medicare Part D Creditable Coverage

The Inflation Reduction Act imposed changes to Medicare Part D for 2025. The changes reduce an individual’s out-of-pocket amount and remove the coverage gap (“doughnut hole”). These changes may affect the creditable coverage status of an employer’s group prescription drug coverage as the actuarial value of coverage through Part D will increase.

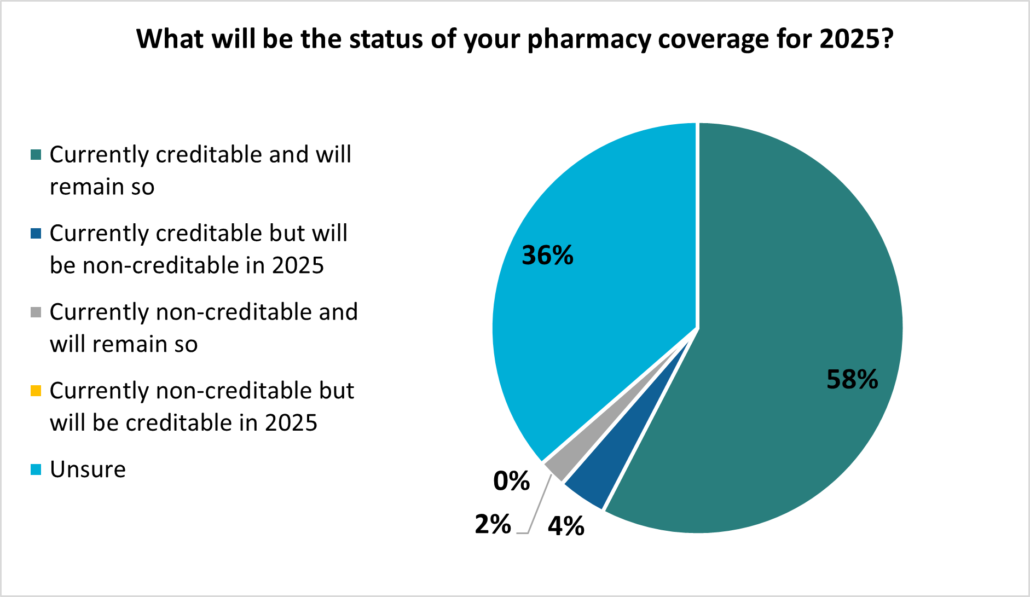

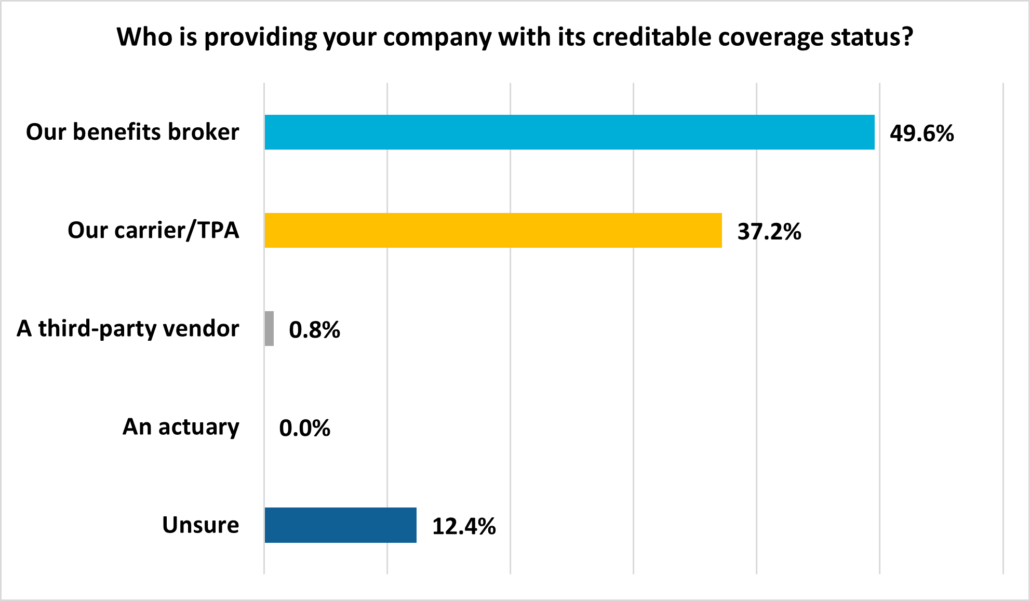

On September 19, we conducted a survey to better understand how employers’ creditable coverage status is changing (or not) for the coming year. The results are in the charts below.

Creditable Coverage – coverage is deemed creditable if the actuarial value of the employer plan is equal or greater than the actuarial value of the standard prescription drug coverage under Medicare Part D.

*Results based on 133 employer respondents.

Key Findings

Employers are not required to offer creditable coverage, but they are required to notify plan participants of the plan’s status annually. This information allows anyone eligible for Medicare Part D to decide whether to elect coverage and whether there will be any late enrollment penalties.

From the data provided, most employers who have already completed their determinations will remain creditable for the 2025 plan year. Almost 40% are still unsure of their status as determinations must be made upon plan renewal, and those employers with calendar year plans are still making final decisions. We anticipate that when those employers complete their analysis, the vast majority will keep their creditable coverage status for 2025. The reason behind this belief is the availability of the simplified method for determining creditable status. This method provides an easier path for employers to achieve creditable standing. There are indications that this method may not be at the employer’s disposal in 2026, so we may see a greater change in plans losing creditable status next year.

Employers are overwhelmingly turning to their benefit advisers or health plan administrators for assistance in determining whether their plans are creditable.

It is important to include the analysis in renewal planning for employers that have not yet performed it. All employers should be prepared to conduct a more thorough analysis for their 2026 plan year.

Should you have any questions regarding any of this information or want to discuss your plan’s status, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!