Employee Benefits Market Check Survey: Mid-Year Election Changes

Companies that provide employee benefits to their workforce usually offer an enrollment period every year, allowing workers to purchase new coverages or change/drop coverages they currently have. While much of the benefit selection activity happens during that enrollment window, there are still times throughout the remainder of the year when employees will want to make changes. Some mid-year changes are based on life events that require the employer to allow the employee to make a change, while others are at the plan sponsor’s discretion.

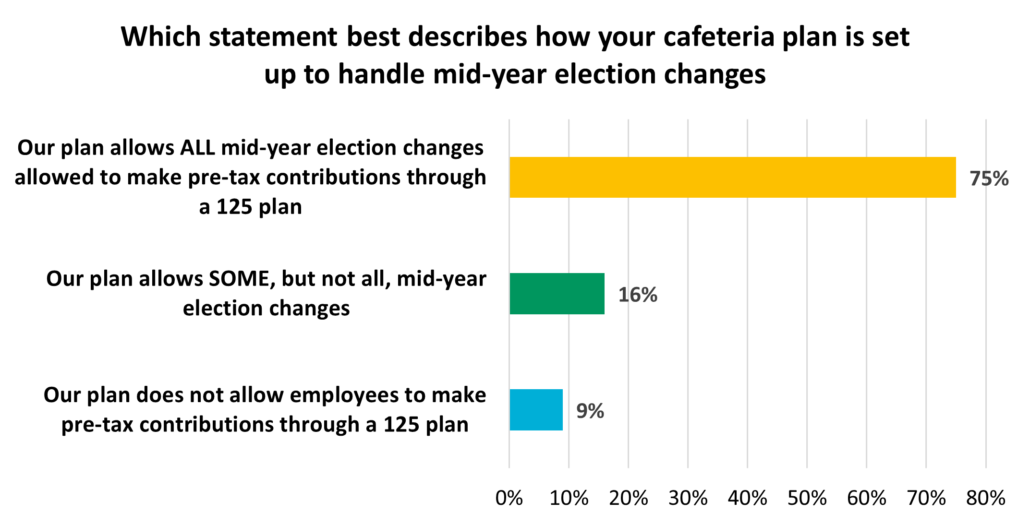

For those instances where the employer may permit a mid-year election change to employee pre-tax contributions, we wanted to learn how employers have structured their cafeteria plan. The results are in the chart that follows.

*Results based on 233 employer respondents

Key Findings

Our experience has shown that most employers allow all permitted mid-year election changes, and the data above supports that hypothesis. Permitting all scenarios is the easiest way to administer and communicate life event changes and provides employees the most flexibility.

Employers that allow some but not all mid-year election changes should ensure that the cafeteria plan documents and summary plan descriptions are clear on what is allowed and what is not.

Regardless of whether your plan allows for some or all the events to trigger an election change, it is important to note that rules vary by benefits. Ensure you know which benefit the employee wants to change before determining if the plan will permit it.

Should you have any questions regarding any of this information, want to review which events permit election changes or industry data, or review your plan documents, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!