Inflation and the Impact on 2023 Insurance Purchasing — Industry Spotlight

This piece was written as a companion to our September 2022 Market Check Survey: Inflation and the Impact on 2023 Insurance Purchasing, to highlight perspectives from specific commercial industries.

Inflation continues to be an issue for many Americans. High prices are impacting their wallet in several areas. As we near annual enrollment time, inflation fears may impact what and how employees purchase insurance coverage through their employer. In May, we asked businesses if their workers were having a more difficult time affording their benefits than two years ago. Over 47% confirmed their workforce was struggling.

Now, as employers plan their communications for the 2023 benefits year, almost half say they are concerned that the economy will cause employees to reduce the insurance they purchase this year.

We conducted a poll during a webcast on September 22 to get a glimpse of employers’ perspectives on how they feel employees will change buying habits and how they may help alleviate some of the stress. The results, by industry, are in the charts below.

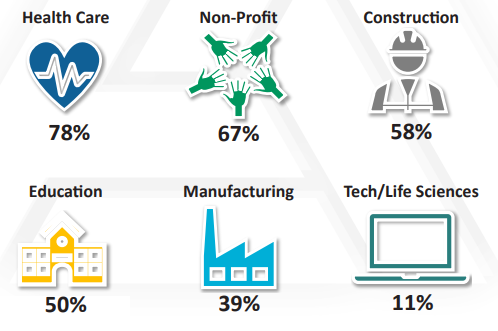

Percent of employers by industry that are concerned inflation will

cause their employees to scale back the insurance they purchase in 2023

Employers in the Health Care and Non-Profit segments are more concerned about their workforce reducing their insurance than other industries. Those two have historically had challenges in the compensation area and may have additional pressure on their salary budget if a recession takes hold. Without salary market increases, those employees may be pushed to reduce their benefits coverage. Employers facing this challenge should consider extending the enrollment period to allow employees additional time to choose wisely.

Each employee’s insurance needs will be unique. It is more important than ever to provide year-round communication on the employee benefits package to ensure employees are maximizing their coverage.

Employers that can provide plan options, resources, and decision-making support will be better positioned to have a workforce that feels secure in the coverage it purchases. A workforce that is confident with its insurance protection is a workforce that is more resilient, more productive, and more satisfied.

Should you have any questions regarding any of this information or about other avenues to explore, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!